Salary Packaging

About Salary Packaging

Salary packaging (also known as salary sacrificing or total remuneration packaging) lets you exchange part of your pre-tax salary for valuable benefits—such as car leases, super contributions, or everyday expenses—so you keep more of what you earn.

Your Pay, Your Way: Maximise Every Dollar

Benefits at a Glance

- Tax Savings & More Take-Home Pay

Reduce your taxable income by allocating pre-tax dollars to essentials, unlocking more disposable income. - Flexible Benefit Options

Get access to a wide range of benefits—like vehicles (novated leases), super contributions, laptops, relocation costs, living expenses, and more—tailored by sector or employer. - FBT-Exempt Benefits Available

Certain items—like work-use laptops, protective clothing, and briefcases—are exempt from fringe benefits tax, giving you more value. - Extra Super Contributions

Boost your retirement savings through pre-tax super contributions, often taxed lower than your regular income.

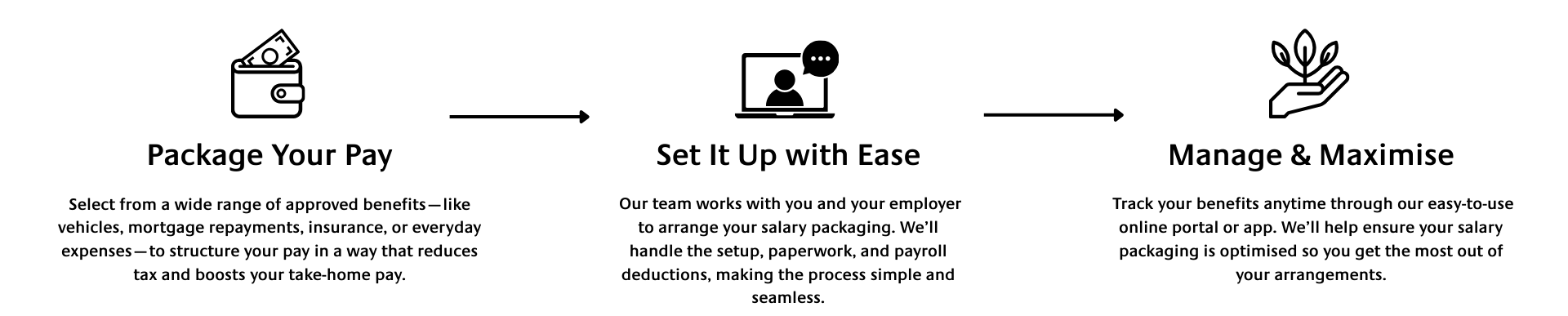

How it works

What You Can Package

Depending on eligibility, you may be able to package:

Novated lease vehicles

Mortgage or rent payments

Everyday living expenses

Insurance premiums

School fees and personal loans

Work-related tech (laptops, phones, tablets)

Memberships and professional subscriptions

Ready to setup your Salary packaging?

Book a personalised consultation today and find out how salary packaging can reduce your tax, boost your take-home pay, and make the most of your employee benefits.