Australia’s shift to electric vehicles isn’t happening by accident. It’s being driven by tax policy.

New industry data from Metro Finance shows that when incentives change, behaviour follows immediately. With the Federal Government reviewing the Electric Car Discount and EV delivery times stretching up to three months for some models, timing has become one of the biggest factors in securing today’s benefits.

Here’s what the data reveals and why acting early matters.

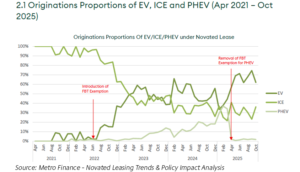

When the Fringe Benefits Tax (FBT) exemption was introduced in July 2022, it didn’t create a gradual lift in EV interest. It triggered a structural shift.

Since the exemption began:

This wasn’t hype. It was a direct response to better financial outcomes through salary packaging.

In April 2025, plug-in hybrids lost eligibility for the FBT exemption.

Within one quarter, demand dropped by almost 94 percent.

Nothing about the vehicles changed. Only the tax setting did.

That single data point tells the whole story: incentives don’t just influence decisions. They drive them.

Metro Finance’s data also shows that EV uptake is strongest among Australians aged 25 to 44. This is the core working demographic with stable incomes and access to employer-supported novated leasing.

EV adoption is no longer limited to early adopters or premium buyers. With more competitively priced models entering the market, the transition is accelerating across broader income groups.

Affordability is improving, but supply remains a real-world constraint.

Depending on brand and specification, EV delivery timeframes commonly range from 8 to 12 weeks. Some models can take longer.

With the Electric Car Discount under active review, waiting to “decide later” can mean:

In short, the clock isn’t just set by policy. It’s set by production and supply chains too.

Right now, eligible EVs still qualify for the FBT exemption. But the policy is being reviewed.

Metro Finance’s data shows what happens when incentives are introduced and what happens when they’re removed. Behaviour changes immediately.

For novated leasing, what matters is the rulebook at the time your lease is established, not when you begin researching options.

That’s why many employees and fleet managers are choosing to act earlier. It locks in certainty in an environment where both policy and supply are moving targets.

For employers, EV novated leasing remains one of the most attractive benefit offerings available, combining sustainability outcomes with real financial value.

For employees, current settings offer some of the strongest total cost advantages EVs have ever had.

For fleet managers, today’s incentives create an opportunity to lower emissions and operating costs while government policy still supports the transition.

Across all groups, the message is consistent: opportunity windows exist, but they don’t stay open forever.

Ready to explore your EV novated lease options?

Ready to explore your EV novated lease options?Whether you’re planning your first EV, transitioning a fleet, or reviewing employee benefits, Prosperity Smart Drive can help you navigate current incentives and delivery timelines.