Enhance Your Employee Experience with Prosperity Benefits

Prosperity Employee Benefits helps you attract, retain, and reward your staff with a suite of exclusive services including salary packaging, novated leasing, lending solutions, and personalised financial planning.

Benefits That Attract, Retain, and Inspire

Today’s workforce values more than just a salary. Offering comprehensive employee benefits demonstrates your commitment to staff wellbeing and financial security. Prosperity Employee Benefits provides a complete package that helps your team reduce tax, access finance, plan for the future, and enjoy lifestyle perks – all while strengthening loyalty, engagement, and productivity.

Salary Packaging for your Employees

Salary packaging is a simple way to boost take-home pay while offering tax efficiencies. Employees can package benefits like super contributions, devices, professional memberships, and more. Prosperity handles setup, compliance, and ongoing support, making it easy for employers to offer this valuable benefit without additional administrative burden.

Key Employer Benefits:

- Enhance your Employee Value Proposition (EVP)

- Attract and retain top talent

- Offer cost-effective, tax-smart benefits

Novated Leasing for your Employees

Lease It, Love It: A Smarter Way to Drive

Novated leasing allows employees to drive the car they want while potentially reducing their income tax. It’s a three-way agreement between the employee, employer, and finance provider, with Prosperity Smart Drive handling the setup and administration to make the process seamless.

How it works:

- Employer: Deducts lease payments from pre-tax salary and ensures smooth implementation.

- Employee: Authorises pre-tax deductions for personal or business use of the vehicle.

- Financier: Sources the vehicle and manages contracts, compliance, and administration.

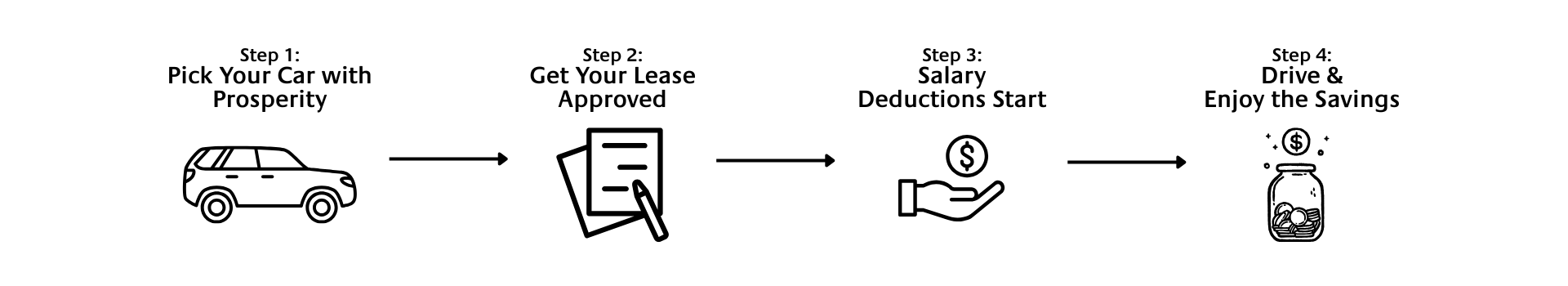

The Journey to a Novated Lease

Lending Solutions for your Employees

Employees gain priority access to Prosperity Lending, helping them achieve homeownership, business growth, or investment goals. Offering access to expert lending advice positions your organisation as a supportive, forward-thinking employer.

Services include:

- Residential Finance: Home purchases, upgrades, or investment properties, with access to 45+ lenders.

- Loan Reviews: Complimentary assessments to ensure employees are getting the best rates.

- Asset Finance: Vehicles, equipment, or business assets with tax-effective structuring.

- Business & Commercial Lending: Financing solutions to support business operations or growth initiatives.

Employer Value:

- Demonstrates genuine care for employee financial wellbeing

- Supports employees through life milestones, boosting satisfaction

- Simplifies access to expert finance advice without additional HR burden

Financial Services for your Employees

Employees can access personalised financial planning, wealth protection, and estate planning through Prosperity Advisers. Offering these services through the Employee Benefits Program helps staff feel secure and supported at every stage of life.

Services include:

- Financial Planning: Tailored strategies for wealth creation, retirement planning, and budgeting.

- Protecting Wealth & Lifestyle: Income protection, life insurance, and risk management.

- Estate Planning: Wills, trusts, superannuation nominations, and succession planning.

Employer Value:

- Reduces employee financial stress, improving productivity and engagement

- Supports long-term employee loyalty and retention

- Enhances your EVP with high-value, meaningful benefits

Empower Your Team with Smarter Benefits

Offer flexible, tax-effective benefits that attract top talent, boost engagement, and simplify administration — all with Prosperity’s expert support.